Over the previous few weeks, it has been clear as day that retail buyers — individuals such as you or myself — have been accumulating Bitcoin, Ethereum, and different cryptocurrencies.

Now we have reported within the past days that the active users of both Bitcoin and Ethereum have began to rocket, regardless of March’s crash.

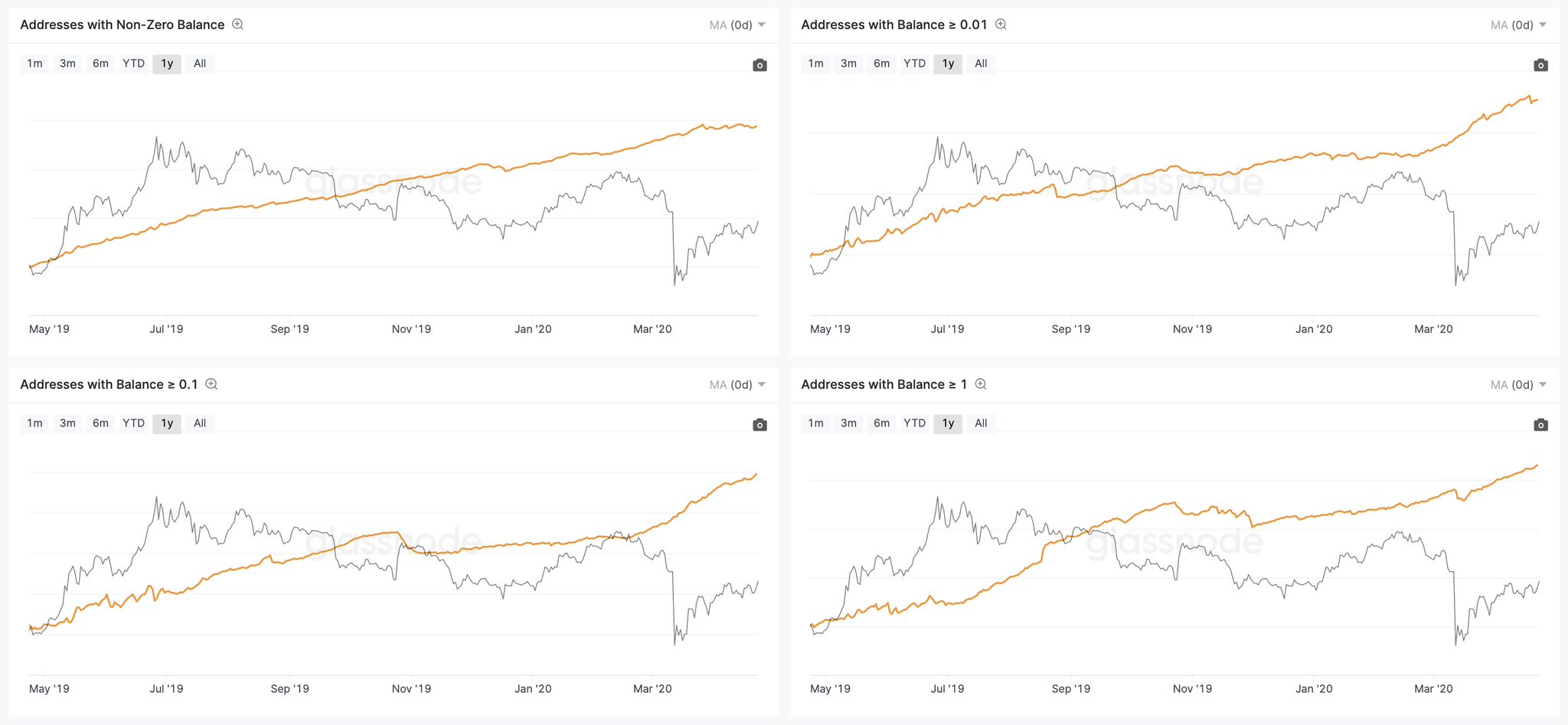

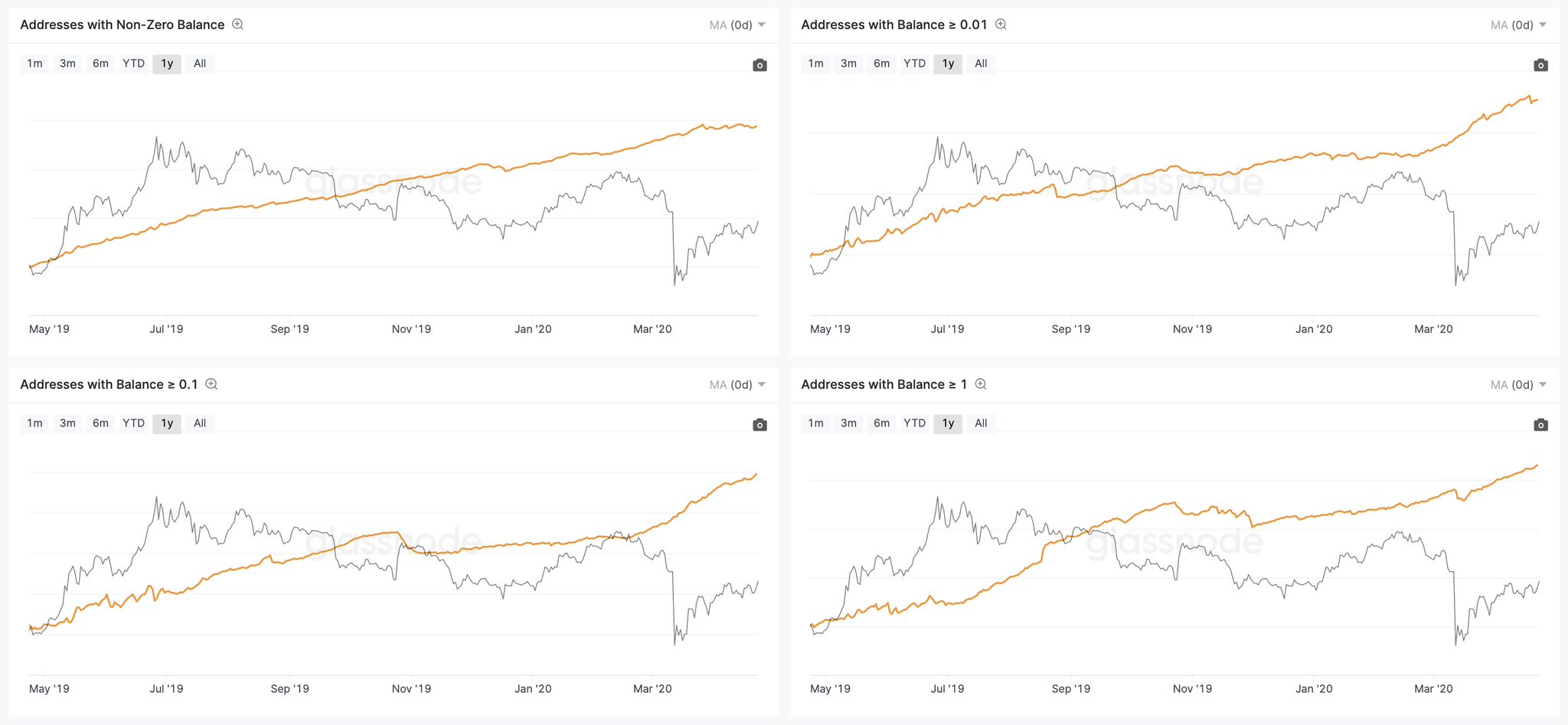

Concurrently, knowledge from blockchain evaluation startup Glassnode has found that the variety of addresses holding 0.1 to 100 ETH and 0.01 to 1 BTC — addresses affiliated with retail buyers — has grown dramatically over the previous two months.

It’s a development indicating that retail buyers are shopping for the dip within the cryptocurrency market, accentuated by BTC’s 20 percent performance just the other day that was largely predicated on strong buying volume from Coinbase, Binance, and different retail exchanges.

However in keeping with a brand new evaluation, some large establishments — like recognizable names like IBM Blockchain and Microsoft — are accumulating cryptocurrencies as nicely.

However the cryptocurrency they’re identified to be accumulating could also be sudden: Ethereum.

Fortune 500 establishments — IBM, Microsoft, and extra — are spending tens of millions on Ethereum

Adam Cochran, a accomplice at Metacartel Ventures and an adjunct professor at Conestoga Faculty in Canada, not too long ago launched an intensive evaluation of the highest 10,000 ETH addresses (by holding measurement).

Whereas his report revealed many desirable discoveries concerning the intricacies of the second-largest cryptocurrency, what was particularly attention-grabbing is that in keeping with Cochran, his staff recognized “wallets related to main gamers reminiscent of JPMorgan Chase, Reddit, IBM, Microsoft, Amazon, and Walmart.”

The main points had been scant, however the crypto investor asserted that “100%” of those wallets are accumulating ETH. Once more, it wasn’t clear how a lot they had been accumulating, however contemplating they’re throughout the prime 10,000 addresses on your entire Ethereum community, these companies probably maintain tens of millions of {dollars} between them.

Importantly, there may be presently no option to inform if these similar corporations are accumulating BTC as they’re doing with Ether as a result of the best way Bitcoin operates makes it considerably harder to tie an tackle to 1’s identification.

However contemplating that Microsoft and different Fortune 500 corporations have been revealed to be dabbling in using Bitcoin for business purposes, there’s a superb chance they’re.

Establishments have been accumulating for some time now

Establishments and different massive gamers within the cryptocurrency house have been accumulating Ethereum for a while now, knowledge exhibits.

As reported by CryptoSlate previously, Grayscale Investments, the funding arm of crypto conglomerate Digital Currency Group, has bought roughly 756,540 ETH in 2020 — 40% of the cryptocurrency minted via mining this yr to this point.

Grayscale gathered these cash in response to institutional shopping for quantity behind its second flagship product, the Ethereum Belief, ETHE. The product was discovered to have seen large inflows in Q1 of 2020, 88% of which got here from institutional gamers.

As Spencer Midday explained:

“Institutional buyers are shopping for ETH. The cat is formally out of the bag. From the most recent Grayscale report: Ethereum Belief noticed $110M in Q1 inflows That is greater than all of its earlier inflows mixed for the previous 2 years ($95.8M).”

To not point out, Su Zhu of crypto and foreign exchange fund Three Arrows Capital noticed that on Apr. 10, there was a big Ethereum purchase wall on Bitfinex, with consumers placing up a jaw-dropping 250,000 ETH price of bids between $159 and $162, amounting to a price of round $40 million.

What’s behind the shopping for stress?

Stepping again from the Fortune 500 establishments talked about, what’s behind the broad surge to accumulate Ether?

It appears to be centered round Ethereum 2.0.

Inside the coming months, builders will likely be rolling out probably the most hyped technical improve (aside from Segwit possibly) to a blockchain of all time: Ethereum 2.0. This transfer will change the cryptocurrency’s financial mannequin and improve the performance of Ether, a lot in order that Cochran defined in a earlier evaluation that he expects the upgrade to cause a massive economic shift in society.

Except for Ethereum, there are basic traits which have accentuated the worth of cryptocurrencies as a complete.

Particularly, the Federal Reserve and different centralized establishments printing fiat cash en-masse have proven how fragile the standard monetary system is, and the way Bitcoin and different digital property might be seen as a means out or a hedge in opposition to a potential collapse of the system, as described by Raoul Pal.

Posted In: Ethereum, Analysis, Enterprise