Over the previous week, Ethereum is burning hotter than ever.

As a part of EIP (Ethereum Improvement Proposal) 1559, launched all the way in which again in August 2021, the protocol has been burning ETH (crypto lingo for destroying) at a massive rate.

As per EIP-1559, a portion of all Ethereum transactions are destroyed: a chunk of each NFT commerce, yield technique, and even easy token transfers. It’s all getting torched.

Since EIP-1559 was carried out, a grand whole of two.8 million ETH has been faraway from circulation or roughly $4.6 billion at as we speak’s costs.

In simply the final seven days, the Ethereum protocol has destroyed greater than 16,364 ETH at an estimated fee of 1.62 ETH per minute, in accordance with Ultrasound Money.

This burn mechanism additionally means that there’s extra ETH being destroyed than being issued to miners. Provide progress has now dropped to -1.06% per 12 months since EIP 1559. This makes Ethereum extra deflationary than Bitcoin, which was heralded as the unique sound cash (therefore the usage of the ultrasound cash meme by ETH heads).

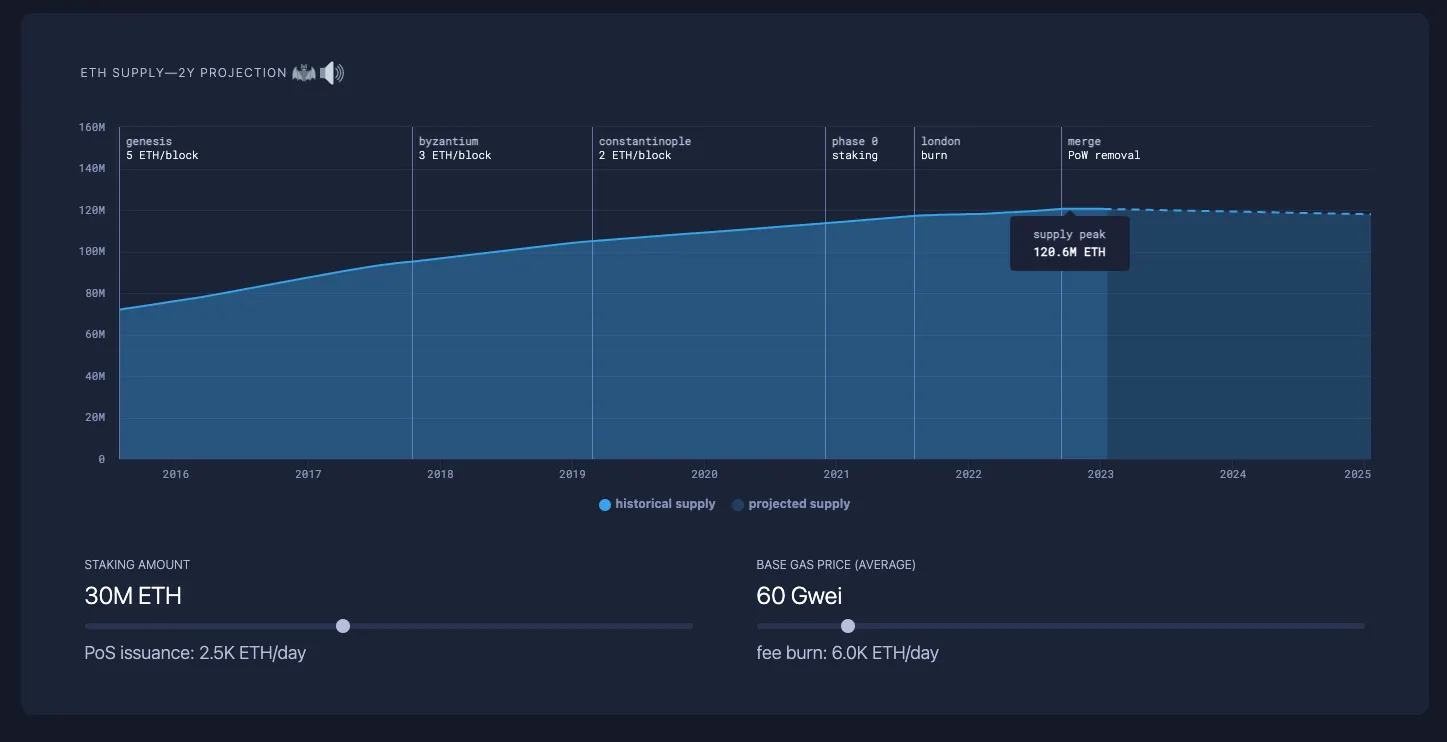

The under chart exhibits how the community’s token provide has modified over varied checkpoints and upgrades. The dotted portion means that the deflationary pattern is anticipated to proceed over the following two years.

The one actual motive that this projection wouldn’t be fulfilled can be if ETH adoption and utilization falls off a cliff. Bear in mind: With each transaction on the community, ETH will get burned.

On this method, we’d use this burn fee as one other strategy to measure adoption for the community.

So, which use classes (as outlined by Ultrasound Cash) are main adoption on Ethereum? Over the previous week, it is NFT and DeFi exercise fueling Ethereum’s flame.

These two classes have been chargeable for the destruction of just about 8,000 ETH this week, with the market leaders in every class—OpenSea (~1,298 ETH) and Uniswap V3 (~876 ETH)—being the important thing drivers of that.

This metric additionally offers us a contact extra perception into the stablecoin battle between USDT and USDC. Everyone knows that the previous’s market cap remains to be miles forward of the latter’s, however Tether’s providing can also be chargeable for greater than 3 times the quantity of Ethereum being burned.

USDT transfers burned roughly 705 ETH this week, whereas USDC transfers burned simply 228 ETH. In different phrases, USDT continues to guide utilization by way of stablecoin adoption on Ethereum.

As community exercise continues apace, the Ethereum neighborhood will proceed to look at it burn.