An analyst defined how Bitcoin’s availability for buying and selling has quietly declined through the asset’s latest consolidation section.

Bitcoin Might Be In A Good Place To Set New All-Time Highs

In a brand new post on X, analyst Willy Woo discusses the latest pattern within the Bitcoin stock sitting on centralized exchange platforms.

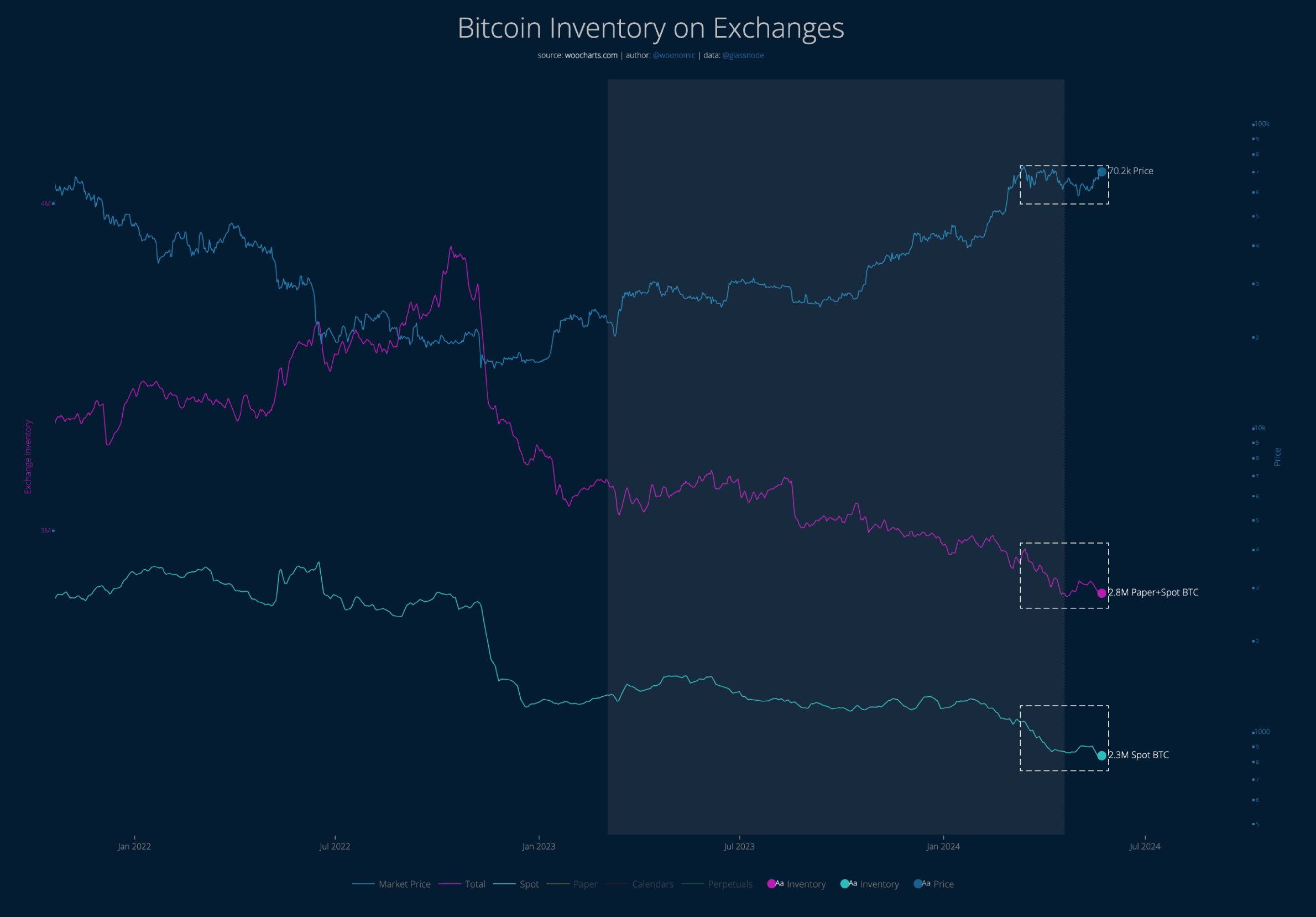

The chart beneath reveals how the spot and paper BTC reserves have modified over the previous few years.

Because the graph reveals, the Bitcoin sitting in spot wallets has been declining over the past couple of months. The full quantity of such BTC within the custody of central entities has now dropped to only 2.3 million.

It’s additionally obvious that the whole sum of the spot and “paper” BTC (highlighted in purple) has declined on the similar time. Paper BTC right here refers to derivatives merchandise associated to cryptocurrency that don’t really require buyers to personal the asset.

Thus, on condition that the mixed sum of the change stock has gone down for the cryptocurrency, it might seem that the lower within the spot BTC isn’t as a result of paper BTC has changed it.

Typically, the provision of exchanges is taken into account a part of the Bitcoin provide, which is “accessible” for buying and selling. As such, as a result of how supply-demand dynamics work, much less of this accessible provide could also be a constructive signal for the cryptocurrency.

From the graph, it’s seen that this decline within the change stock has come throughout a interval the place the worth of the cryptocurrency has struggled after setting a brand new all-time excessive (ATH). As Woo notes,

Whereas everybody was freaking out that Bitcoin worth was not rising the final 2 months, accessible BTC was quietly being scooped up, and importantly with out paper BTC printed as a substitute.

Thus, the truth that the accessible provide has gone down throughout such a interval might be a bullish signal for the coin. “It’s solely a matter of time earlier than BTC squeezes previous all-time highs,” says the analyst.

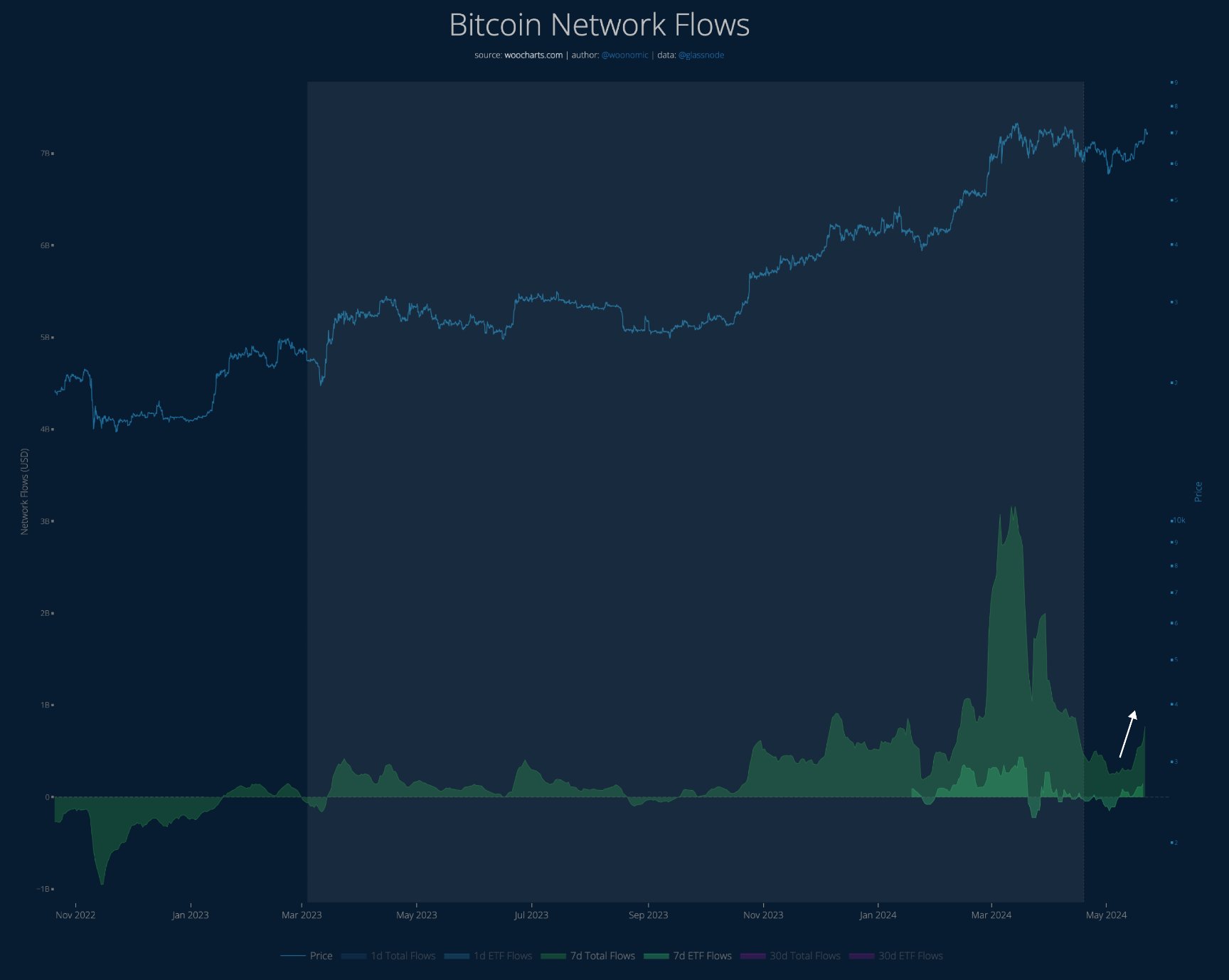

In one other X post, Woo additionally mentioned how capital inflows into Bitcoin have simply began to select up once more after registering a steep drop earlier.

Because the chart reveals, community inflows spiked alongside the all-time excessive, however they noticed a significant slowdown within the consolidation that adopted.

The inflows from spot exchange-traded funds (ETFs), highlighted in gentle inexperienced, additionally disappeared earlier, however they’ve now made a comeback alongside these recent capital inflows.

BTC Worth

Bitcoin had recovered as excessive as $71,000 earlier however seems to have slipped off over the previous few days because it has now returned beneath the $68,000 stage.

Featured picture from Shutterstock.com, woocharts.com, chart from TradingView.com