An analyst has defined how the Bitcoin rally might nonetheless have room to run earlier than hitting a prime primarily based on the information of this indicator.

Bitcoin Macro Oscillator Isn’t At Historic Prime Zone But

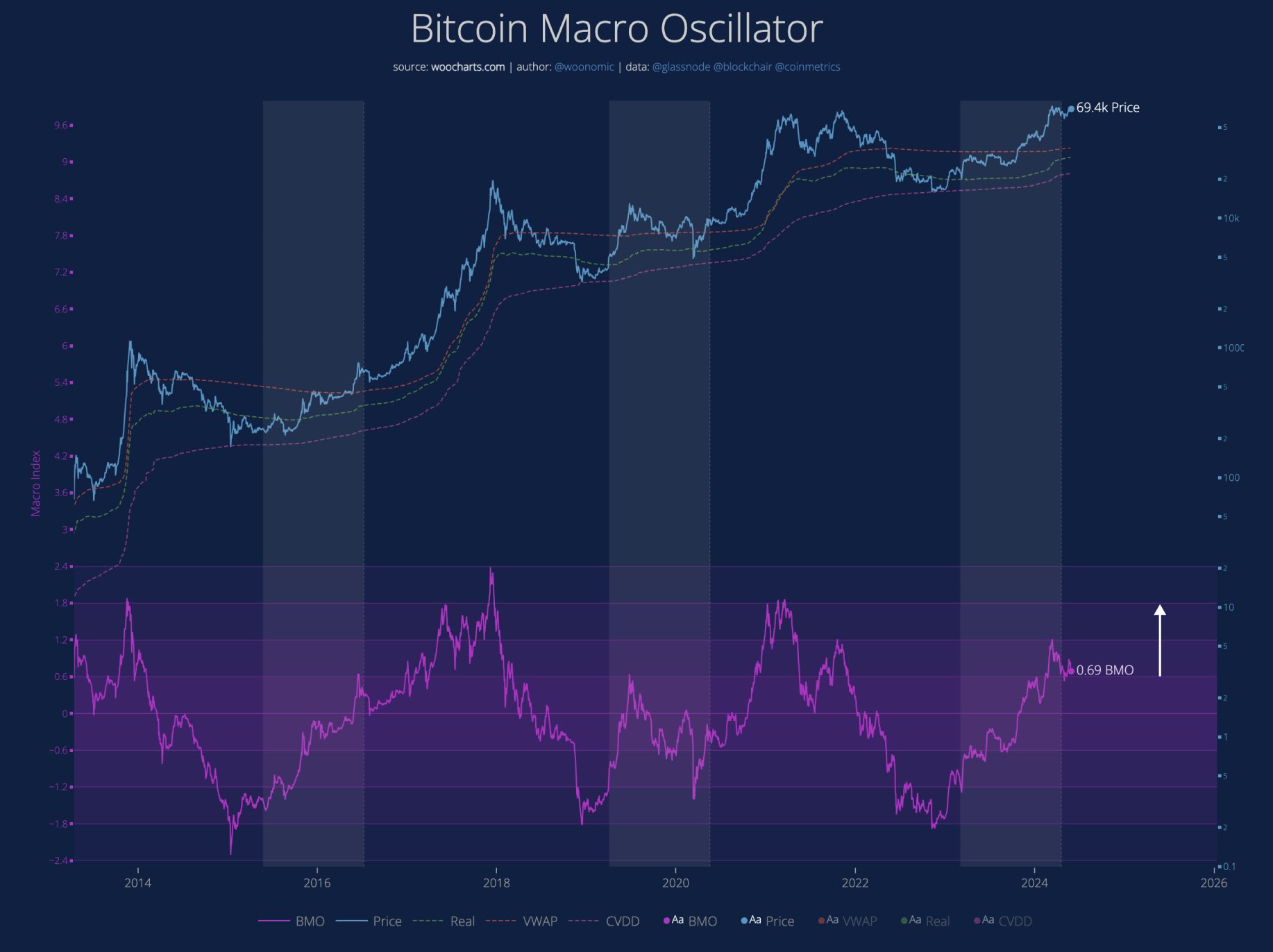

In a brand new post on X, analyst Willy Woo has mentioned the current development growing within the Bitcoin Macro Oscillator (BMO). This indicator combines 4 totally different metrics to supply an oscillating worth across the zero mark.

The symptoms in query are the market Worth to Realized Worth (MVRV) ratio, Quantity-Weighted Common Value (VWAP) ratio, Cumulative Worth-Days Destroyed (CVDD) ratio, and Sharpe ratio.

The chart beneath reveals how the oscillator primarily based on these metrics has fluctuated in worth over the previous few Bitcoin cycles.

From the graph, it’s seen that tops within the cryptocurrency’s worth have traditionally coincided with the metric reaching comparatively excessive ranges. Extra notably, the 2013 and 2021 tops occurred when the indicator breached the 1.8 degree, whereas the 2017 peak occurred when the oscillator hit 2.4.

Up to now, within the present rally, the oscillator has achieved a peak worth of 1.2. This excessive coincided with the asset’s all-time excessive (ATH) worth, which continues to be the highest of the run so far.

When contemplating the historic precedent, although, this worth doesn’t appear to be excessive sufficient for the highest to have been cyclical. Because the coin’s worth has consolidated since this excessive, the oscillator has cooled off, now hitting simply 0.69.

Thus, the asset has gained extra distance from the zone the place tops have occurred up to now. “This 2.5 months of consolidation below bullish demand has been superb for Bitcoin; it means the value has extra room to run earlier than topping out,” notes Woo. The analyst means that BTC might now have 2 to three ranges of the BMO to climb earlier than reaching the macro prime.

Woo has additionally identified a possible optimistic signal brewing for Bitcoin concerning its net capital flows. Under is a chart displaying this metric’s development over the previous few years.

As displayed within the graph, web capital flows into Bitcoin had been fairly excessive through the surge towards the value ATH, however cash stopped flowing in because the asset fell into sideways motion.

Throughout Could, although, the web flows have lastly reversed the development, as they’ve been on the rise as soon as extra. This contemporary demand can naturally be bullish for the cryptocurrency’s worth.

BTC Value

Bitcoin surged above the $70,500 degree earlier, however the coin has since slumped again down, buying and selling round $67,800.

Featured picture from Dall-E, woocharts.com, chart from TradingView.com